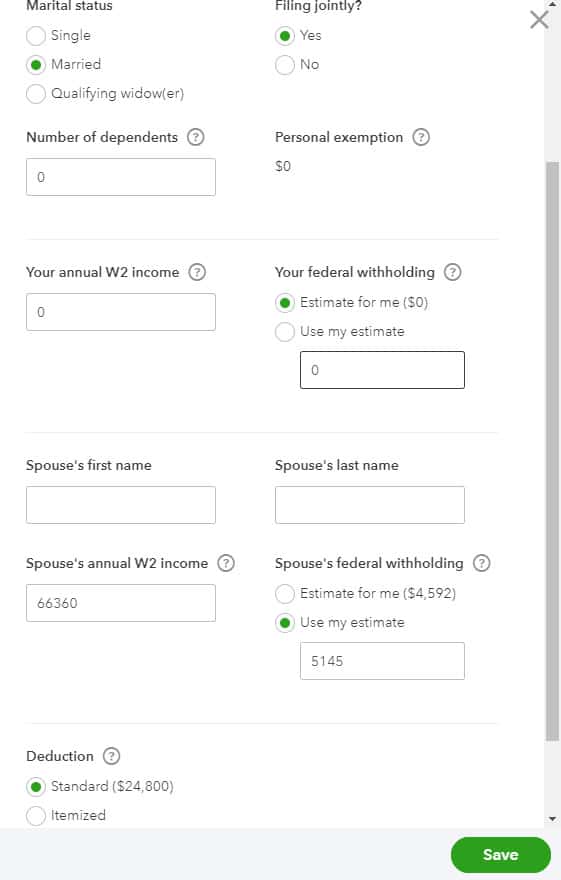

how much should i set aside for taxes doordash reddit

Generally you should set aside 30-40 of your income to cover both federal and state taxes. Other drivers track the change in mileage from when they start.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

The answer is NO.

. The fields on the 1099-K form are quite. A common question is does Doordash take out taxes. There are a lot more moving.

How much should I set aside for taxes DoorDash. Whether you file your taxes quarterly or annually. Online says 30 but at that much I couldnt pay bills.

Generally you should set aside 30-40 of your income to cover. Dont forget to set aside money for vehicle maintenance. I use stride and its pretty accurate come tax time.

How much SHOULD you put aside from your earnings for taxes. As an independent contractor you should set aside enough to cover the 153 self-employment tax and at minimum 10 federal income tax. I just started door dash and will have a 1099 how much should I set aside for taxes from a paycheck.

Learn how much should you set asi. How much should I set aside for taxes DoorDash. Whether you file your taxes quarterly or annually you need to set aside a portion of.

You must know how much tax. For the 2021 tax year that means 56 cents per mile gets. Generally you should set aside 30-40 of your income to cover both federal and state taxes.

Youll be glad you did when its time to take your car in for repair. I use the Stride app for tracking mileage. At the taxes with Doordash policy food deliverers will get this form regarding the payment of taxes.

1000 per year People who earn 1000 each year working as a Dasher should save 153 of their profits or 153. Take a look at this complete review to Doordash taxes. Heres how much you should set aside for different levels of income.

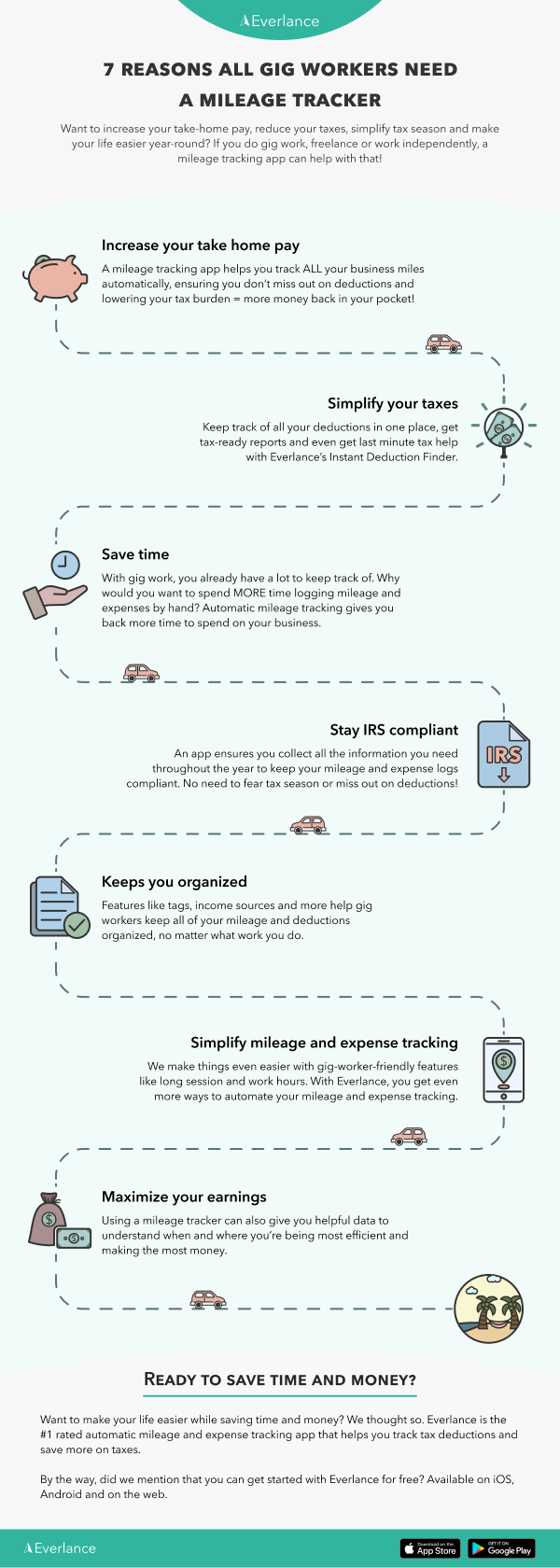

Tracking your mileage and expenses is the key. For most of us delivery drivers with third party delivery services a big part of that is all those miles we put on our cars.

Doordash Delivery Driver What I Wish I Knew Before Taking The Job

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

Tips For Filing Doordash Taxes Silver Tax Group

.png)

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

The Best Times To Doordash In 2021 With Tips From Reddit

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Doordash Tipping Guide What You Need To Know Before You Order Maid Sailors

What Miles Can I Claim As A Delivery Or Rideshare Contractor

Doordash How Much Should I Set Aside For Taxes Youtube

Tweets With Replies By Everlance Everlance Twitter

Doordash Taxes Does Doordash Take Out Taxes How They Work

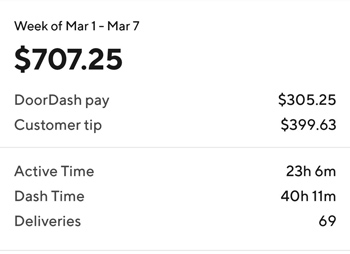

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

Taxes Megathread Talk Taxes Here Only Here R Doordash

Tips For Filing Doordash Taxes Silver Tax Group

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

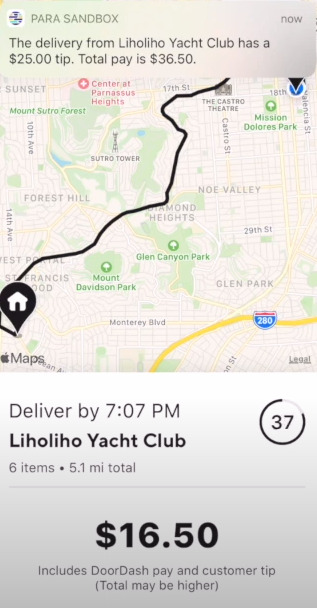

Para App Is Helping Dashers But Could It Get You Deactivated