inheritance tax calculator florida

Co-op Flip Tax Calculator. To find a.

What Are Marriage Penalties And Bonuses Tax Policy Center

There is no personal income tax in Florida.

. Fix or Correct a Return. Not only does Florida forgo state income tax but it also doesnt tax retirement income such as Social Security benefits. Spouse Adjustment Tax Calculator.

In Florida probate the court appointed personal representative also known as the executor is entitled to a personal representative fee. Florida does not have a state income tax. Be sure to file the following.

A tax is also levied on notes bonds mortgages liens and other written obligations to pay that are filed or recorded in Florida. Florida has no estate or inheritance tax and property and sales tax rates are close to national marks. Our network attorneys have an average customer rating of 48 out of 5 stars.

Its such a great place for retirees that eight Florida citiesSarasota Naples Daytona Beach Melbourne Tampa Fort Myers Port St. Your average tax rate is 1198 and your marginal tax rate is 22. Unlike property taxes however the mansion tax paid at the time of purchase is not considered to be tax deductible.

The Impact of The Tax Cuts and Jobs Act by Congressional District. Lucie and Pensacoladominate. Our network attorneys have an average customer rating of 48 out of 5 stars.

Forms and Paper Filing. Capital Gains Tax Calculator. See Form 1040-X Amended US.

Pension income and income from an IRA or a 401k are all untaxed. If you make 70000 a year living in the region of California USA you will be taxed 15111. Individual Income Tax Return Frequently Asked Questions for more information.

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. The rate for these types of contracts is 35 cents per 100 of value. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

Florida sales tax rate is 6. The mansion tax does not generally apply when real estate is transferred via inheritance gift or bequest. Get the right guidance with an attorney by your side.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. What Form Should I File. This marginal tax rate means that.

A stamp tax of 70 cents per 100 of value is assessed on documents that transfer interest in Florida real estate such as warranty deeds and quitclaim deeds. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or. Information regarding these and additional taxes can be located from the list below.

In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax. Our Florida retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. The Florida probate statute that governs personal representative fees in Florida is Section 733617 which allows a percentage fee as well as extraordinary fees.

Major taxes collected in Florida include sales and use tax intangible tax and corporate income taxes. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR.

Request a Copy of a Tax Return. Estates Trusts and the Deceased. Final individual state and federal income tax returns.

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. And it doesnt have estate and inheritance taxes. Get the right guidance with an attorney by your side.

You can file Form 1040-X Amended US. Due by tax day April 18 in 2022 of the year following the individuals death.

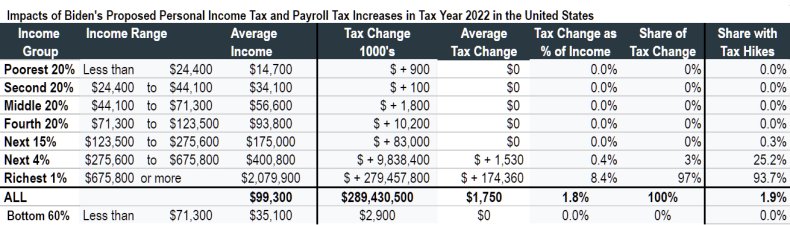

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Investing In Real Estate Tax Lien Certificates Case Study Free Download In 2022 Estate Tax Real Estate Investing Case Study

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Florida Income Tax Calculator Smartasset

Property Tax Calculator Casaplorer

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Gain An Understanding On The Key Concepts You Should Be Considering When Estate Planning For A Dual Estate Planning Professional Education Continuing Education

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Real Estate Agent Real Estate Tax Deductions

How To Calculate Fl Sales Tax On Rent

How To Calculate Inheritance Tax 12 Steps With Pictures

New York Property Tax Calculator 2020 Empire Center For Public Policy